what is suta tax rate for 2021

For 2021 the FUTA tax rate is 6 on the first 7000 of eligible income paid annually to each employee. For calendar year 2021 the mutualized tax rate will be 05.

State Unemployment Tax Ballotpedia

As a result of the ratio of the California UI Trust Fund and the total wages paid.

. You cannot protest an SDI rate. 2021 PDF 2020 PDF 2019 PDF If a forthcoming rate year is not listed those rates are not yet available. Mailing of 2021 rate notices.

The SDI withholding rate is the same for all employees and is calculated annually. The 2021 wage base is 7700. 0010 10 or 700 per employee.

Employers will receive. Texas law sets an employers tax rate at their NAICS industry average or 27 percent whichever is higher. Taxable base tax rate.

Section 96-92c Maximum UI Tax Rate. For 2022 most employers will see a reduction in their social cost factor rate from 075 to 05. 2021 SUI tax rates and taxable wage base.

The Administrative Fund Tax AFT rate for Eligible class 1 and 2 employers is 013. Your UI tax rate is applied to the taxable wages you pay to your employees. The Department mails SUI rate notices Form UC-657 on or before December 31 of each year.

Never combine the UI rate and AFT rate when entering the UI rate in your software. After that you may be eligible for a higher or lower tax rate depending on. The minimum and maximum tax rates for wages paid in 2022 are as follows based on annual wages up to 7000 per employee.

Interest rates will increase from 5 to 15 as we move to Table C. All 2022 Unemployment Insurance Tax Rate. The first 7000 for each employee will be the taxable wage base limit for FUTA.

Get Your Max Refund Today. You can view your tax rate by logging in to the Departments Reemployment Tax file and pay website. The FUTA tax applies to the first 7000 of wages paid to each employee throughout the year.

52 rows Each state has a range of SUTA tax rates ranging from 065 to 68. The AFT for all other employers is 018. According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F.

Therefore the maximum amount in FUTA taxes an employer would pay annually for each employee would be 7000 x 006 420. Section 96-92b Minimum UI Tax Rate. 2022 RESERVE RATIO TABLE.

2021 SUI tax rates. If you are a new employer other than a successor to a liable employer you are assigned a tax rate of 20 percent for a minimum of two calendar years. Section 96-92e Final Date for Protest.

You cannot withhold UI tax from the wages you pay to employees. Jaw-Dropping Update on Massachusetts 2021 Unemployment Tax Rates Each year Massachusetts tax paying employers not Reimbursable employers pay an annual statutory UI Solvency Assessment. The 2021 employee SUI withholding rate remains at 006 on total wages.

You cannot protest an ETT rate. The Taxable Wage Base in effect for the calendar year is listed below. Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes.

When the United States Department of Labor certifies that the states unemployment compensation program meets federal requirements employers that pay their state unemployment tax on time and in full receive a 54 percent credit to be applied against their FUTA tax rate. The tax rate for new employers is 230 in 2022. The SDI withholding rate for 2022 is 110 percent.

This means that any income an employee earns past 7000 is not subject to FUTA tax. The primary purpose of the. Tax rate factors for 2022.

Section 96-92c Mail Date for Unemployment Tax Rate Assignments For 2022. The SUI taxable wage base for 2021 remains at 7000 per employee. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

The SUI taxable wage base continues at 10000 for 2021. Newly liable employers continue with the entry-level tax rate until they are chargeable throughout four full calendar quarters. For 2023 the flat social cost factor rate will cap at 07 instead of 08.

The ETT taxable wage limit is 7000 per employee per calendar year. The taxable wage base for 2022 is 8500. The solvency rate used in the calculation of each companys UI experience for 2021 was announced today and is quickly reverberating through the.

This tax rate is determined by dividing the total unemployment benefits paid to former employees by the total taxable wages paid to all their employees. The new employer SUI tax rate remains at 34 for 2021. The standard employer rate is 1050 in 2022.

The FUTA tax rate protection for 2021 is 6 as per the IRS standards. 12172021 73939 AM. The FUTA tax rate is 60 percent.

0540 54 or 378 per employee. December 15 2021 Final Date for Voluntary Contribution. The ETT rate for 2022 is 01 percent.

24 new employer rate Special payroll tax offset. To see the tax rate schedule ratio rate table and the FUTA creditable factors for ratio-rated employers select the year. FUTA Tax Rates and Taxable Wage Base Limit for 2021.

SB 5873 also gives many small business employers with 10 or fewer employees in fourth quarter 2021 more relief on their social tax rate in 2023. The rate for new employers that are in the construction industry and headquartered in another state also referred to as foreign contractors is 540 in 2022. Employers can access their rate notice information in their UCMS employer portal.

UI Tax Rate for Beginning Employers. 009 00009 for 1st quarter.

What Is Sui State Unemployment Insurance Tax Ask Gusto

Futa Tax Overview How It Works How To Calculate

Oed Unemployment Ui Payroll Taxes

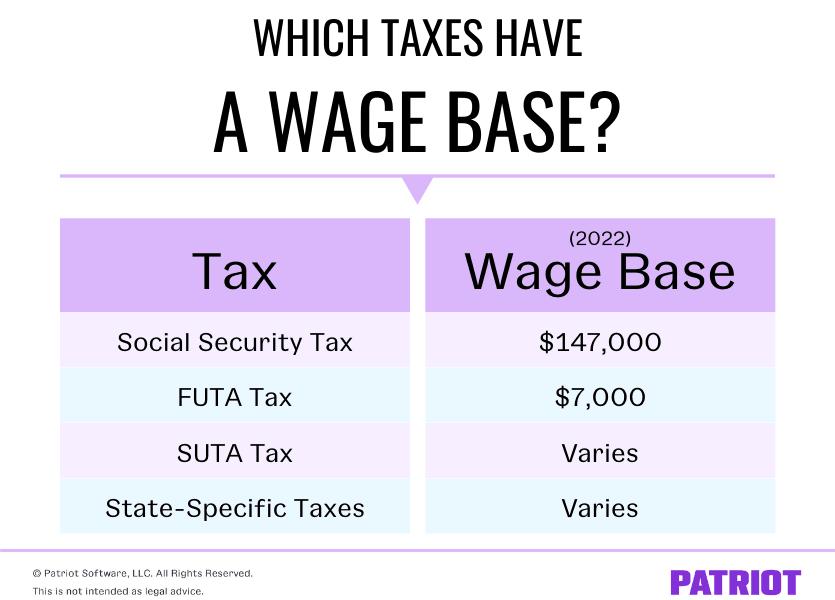

What Is A Wage Base Definition Taxes With Wage Bases More

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Ultimate Guide To Sui And State Unemployment Tax Attendancebot

What Is Suta Dumping Emptech Blog

Suta State Unemployment Taxable Wage Bases Aps Payroll

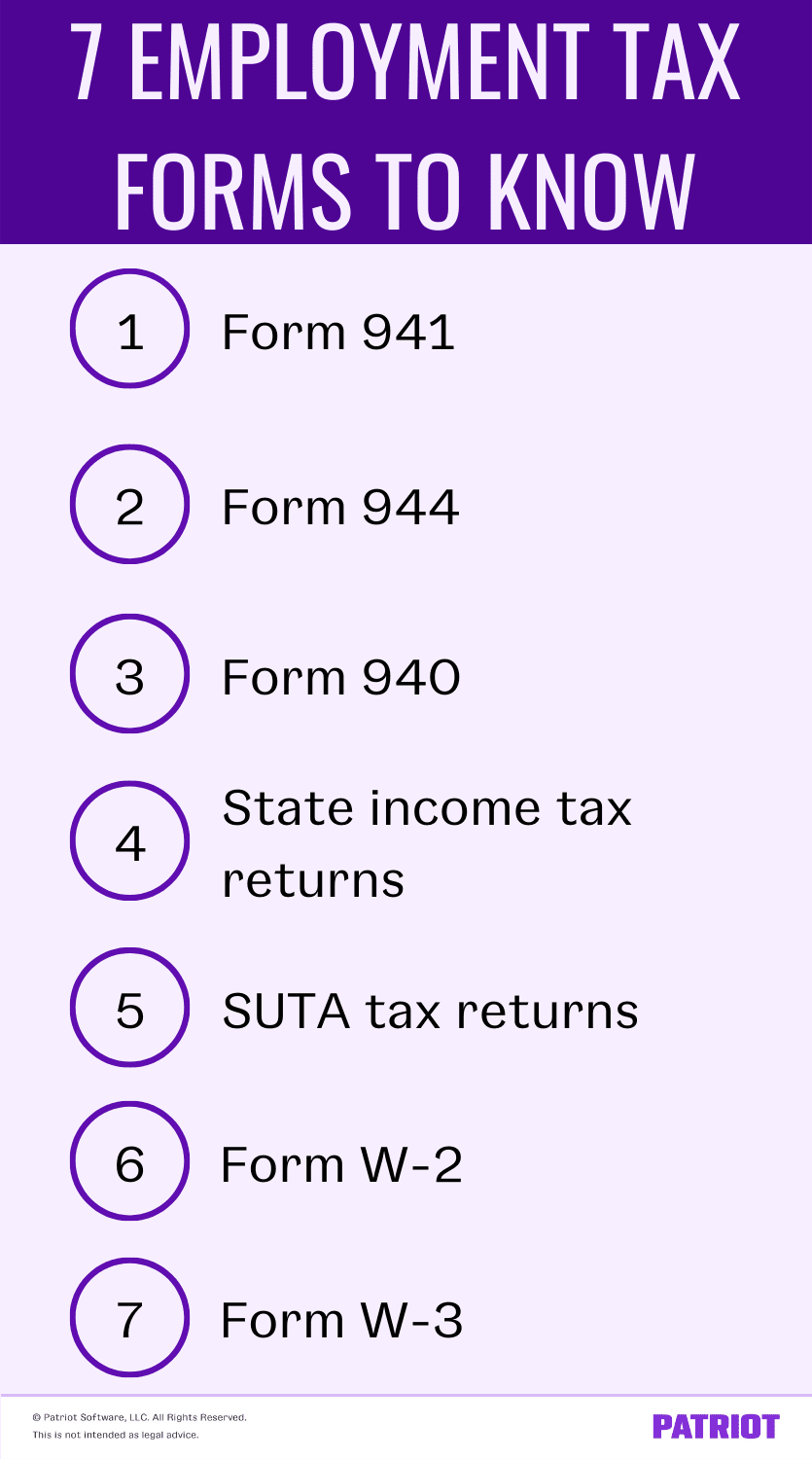

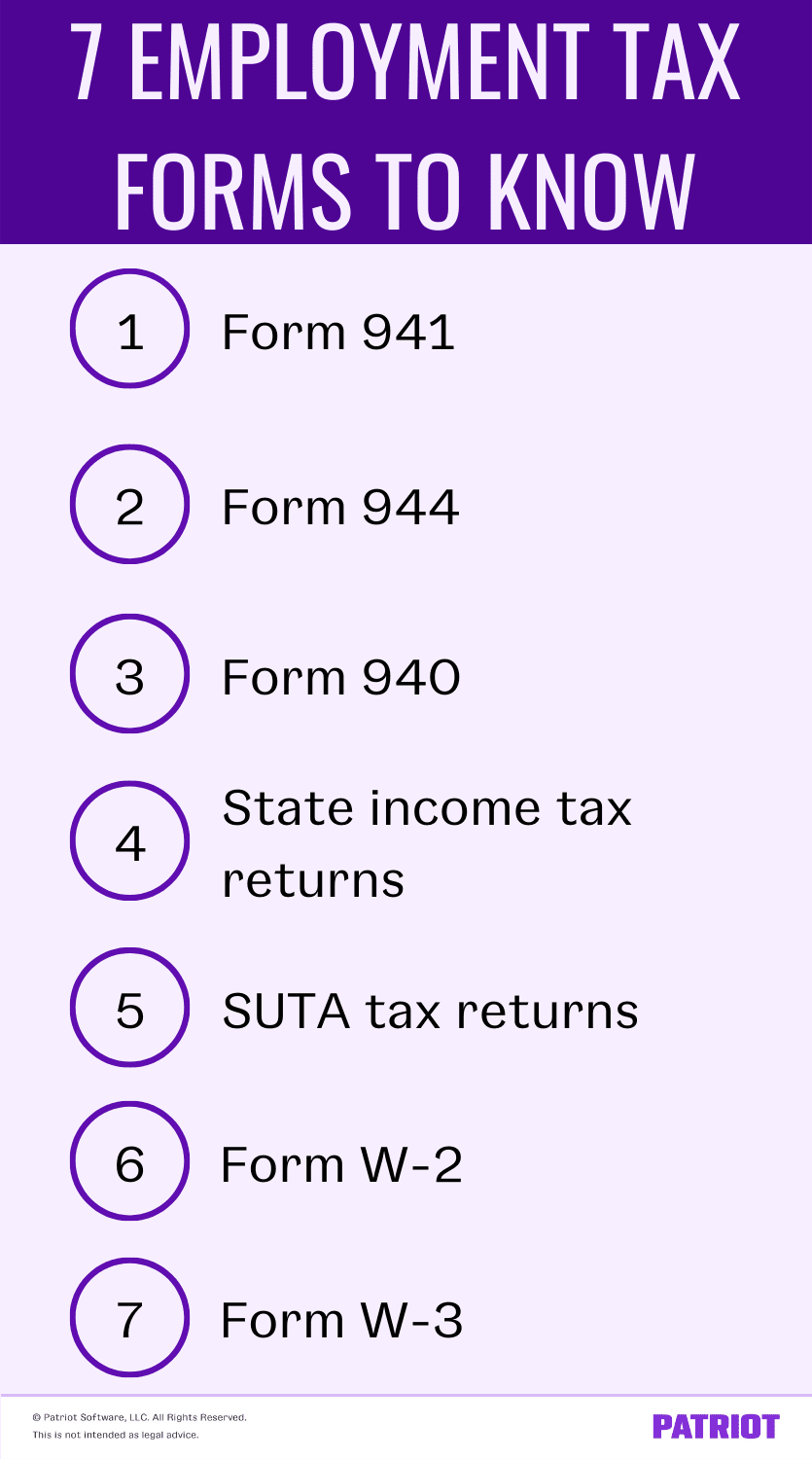

Employment Tax Returns Forms Due Dates More

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Does Social Security Pay In August For July Photo Calendar Examples Calendar Template Social Security

![]()

State Unemployment Tax Ballotpedia

Suta Tax An Employer S Guide To The State Unemployment Tax Act

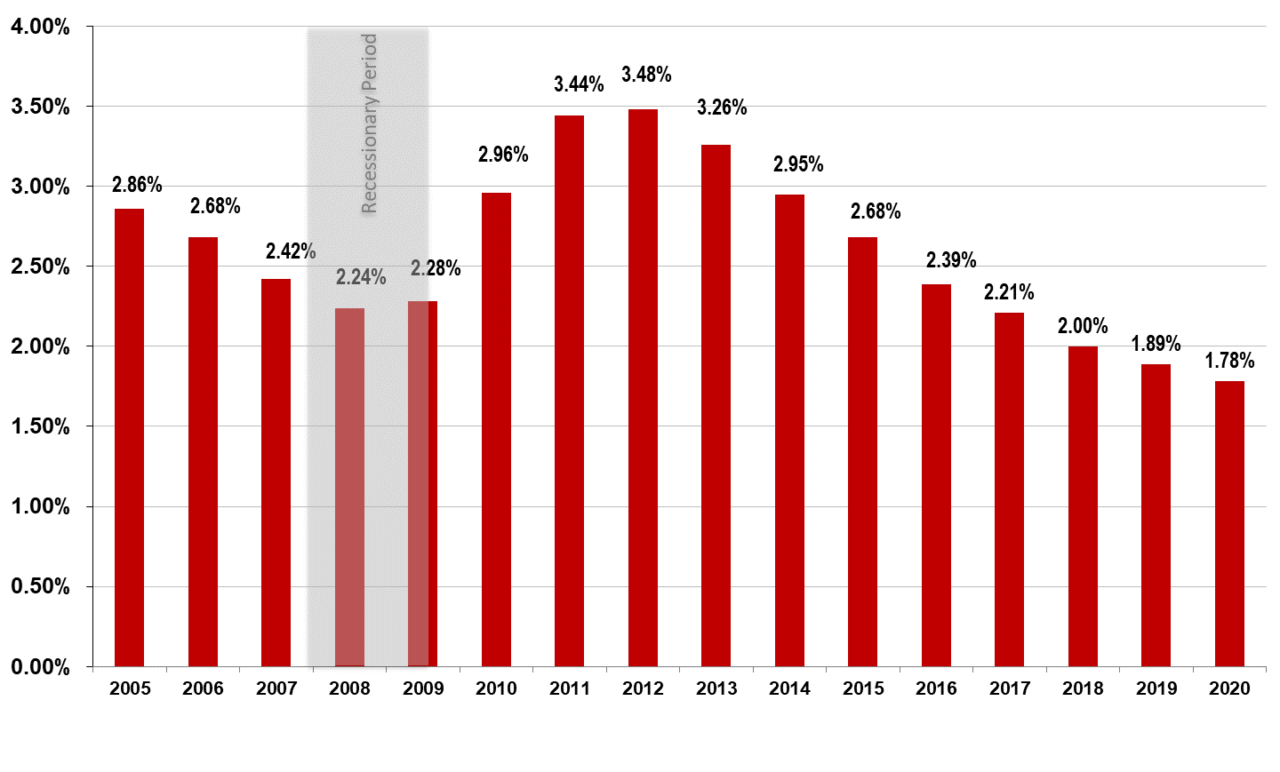

How Severely Will Covid 19 Impact Sui Tax Rates Workforce Wise Blog

State Unemployment Tax Act Suta Tax Rates 123paystubs Youtube

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

940 Futa Suta Tax Rates For 2021 Form 940 Futa Credit Reduction States